INTRODUCTION

Foreign Direct Investment (FDI), in addition to being a key driver of economic growth, has been a significant non-debt financial resource for India’s economic development. Foreign corporations invest in India to benefit from the country’s particular investment privileges such as tax breaks and comparatively lower salaries. This helps India develop technological know-how and create jobs as well as other benefits. These investments have been coming into India because of the government’s supportive policy framework, vibrant business climate, rising global competitiveness and economic influence.

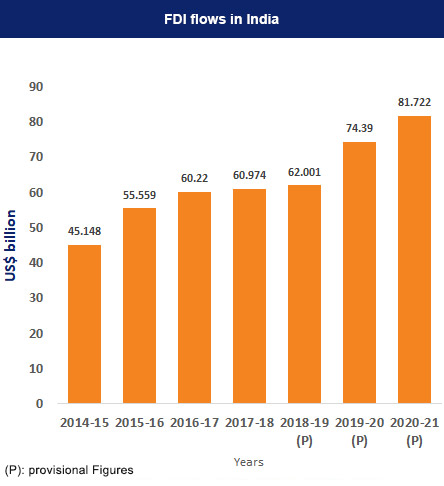

The government has recently made numerous efforts, including easing FDI regulations in various industries, PSUs, oil refineries, telecom and defence. India’s FDI inflows reached record levels during 2020-21. The total FDI inflows stood at US$ 81,973 million, a 10% increase over the previous financial year. According to the World Investment Report 2022, India was ranked eighth among the world’s major FDI recipients in 2020, up from ninth in 2019. Information and technology, telecommunication and automobile were the major receivers of FDI in FY22. With the help of significant transactions in the technology and health sectors, multinational companies (MNCs) have pursued strategic collaborations with top domestic business groupings, fuelling an increase in cross-border M&A of 83% to US$ 27 billion.

India’s FDI inflows have increased 20 times from 2000-01 to 2021-22. According to the Department for Promotion of Industry and Internal Trade (DPIIT), India’s cumulative FDI inflow stood at US$ 871.01 billion between April 2000-June 2022; this was mainly due to the government’s efforts to improve the ease of doing business and relax FDI norms. The total FDI inflow into India from January to March 2022 stood at US$ 22.03 billion, while the FDI equity inflow for the same period was US$ 15.59 billion. From April 2021-March 2022, India’s computer software and hardware industry attracted the highest FDI equity inflow amounting to US$ 14.46 billion, followed by the automobile industry at US$ 6.99 billion, trading at US$ 4.53 billion and construction activities at US$ 3.37 billion. India also had major FDI flows coming from Singapore at US$ 15.87 billion, followed by the US (US$ 10.54 billion), Mauritius (US$ 9.39 billion) and the Netherlands (US$ 4.62 billion). The state that received the highest FDI during this period was Karnataka at US$ 22.07 billion, followed by Maharashtra (US$ 15.43 billion), Delhi (US$ 8.18 billion), Gujarat (US$ 2.70 billion) and Haryana (US$ 2.79 billion). In 2022 (until August 2022) India received 811 Industrial Investment Proposals which were valued at Rs. 352,697 crores (US$ 42.78 billion).